For first-time buyers, it’s looking positive! For some years now, first time buyers (FTBs) have been assessed for affordability based on interest rates that were higher than those actually available in the marketplace. So, although there were some frightening news stories about applicants being offered rates at 9%+ from the end of 2022 into 2023, those were very much the exception, and last year’s rises didn’t affect affordability for most FTBs.

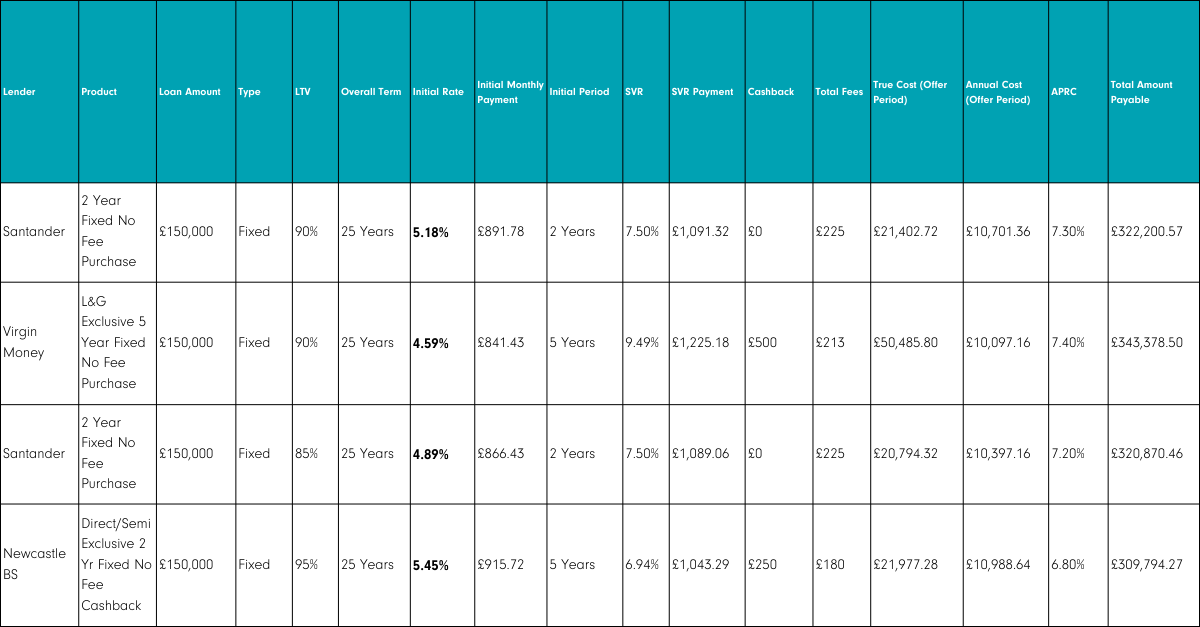

As it stands in the w/c 19 February, the best available rates for FTBs are:

To find out what these rates might mean for you, we have handy online calculators that can give you an idea of how much you might be able to borrow based on your income and what monthly repayments would be, according to the interest rate and amount you’re borrowing.

How affordable are properties for FTBs at the moment?

Probably the most important thing to know about prices if you’re looking for your first home, is that you can always find properties for much less than the average you see or hear quoted – even when they’re talking about your specific area.

For instance, in Reading, you can find a two-bed terrace for around two-thirds of the Land Registry average price for the town, and a two-bed flat for around 45% less. And in Milton Keynes, while the average property price at the start of last year was just over £320,000, you could buy a two-bed flat for just £150,000 and a two-bed terrace for £229,950.

(Source: Propertychecklists.co.uk)

If you’re still struggling to afford open market prices, see if there are any Shared Ownership properties for sale in your area. These schemes allow you to purchase a portion of the property’s value – usually 25% initially, for which you can get a mortgage – and then you pay rent on the remaining portion. In most cases, you have the ability to buy more of the property over time, and when you come to sell, you benefit from the capital growth on the portion you own, which can then help you move up the ladder.

In the run-up to the General Election, rumours of new policy ideas to support FTBs have already been reported, including:

- Mortgages with very long-term fixed interest rates

- Guaranteed mortgages with competitive rates that enable 1% deposits

- Re-introducing Help to Buy

- Further reducing purchase tax (Stamp Duty in England) although few FTBs pay this today

If you’d like to discuss your own circumstances and affordability, our team at Mortgage Scout will be very happy to have a free, no-obligation discussion. You can request a callback from an adviser via our website or call 0800 144 4744.

Your property may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1%, but a typical fee is 0.3% of the amount borrowed.

MAB 17337