By Sarah Thompson, Managing Director of Mortgage Scout

The recent changes in the mortgage market, driven by inflation announcements and the recent Bank of England base rate increase to 5%, have sparked concerns among borrowers. While higher interest rates may cause apprehension, especially for those who purchased homes in the last decade, it is crucial to understand the potential impact and explore strategies to navigate this situation. This article will discuss ways to tighten your spending and pay off your mortgage sooner, ultimately reducing the overall term.

While interest rates have increased due to inflation, it's important to note that the impact may be less severe for individuals accustomed to higher rates. The real challenge lies with those who purchased homes within the last ten years, particularly those on five-year and two-year fixed rates. However, it is worth highlighting that banks and lending institutions perform stress tests to ensure borrowers can afford mortgage payments, factoring in potential interest rate increases.

Although stress tests that most lenders have in place provide some assurance, it's essential to consider the cost of living, which was not as significant during previous stress test scenarios. Rising gas and electricity prices have in the past created a financial strain, with food prices still rising. Consequently, many borrowers fear the end of their fixed-rate term, wondering what their financial situation will look like. Reports suggest an average increase of £24 per month for the average mortgage after an interest rate rise. Therefore, it becomes crucial to assess personal budgets and make necessary adjustments.

Consider adopting an active approach to alleviate concerns and take control of your mortgage. Even small additional payments can make a substantial difference over time. Instead of viewing your mortgage payment as a fixed expense, explore opportunities to overpay and reduce the principal amount. Many lenders allow borrowers to overpay up to 10% annually, providing a chance to chip away at the outstanding balance incrementally.

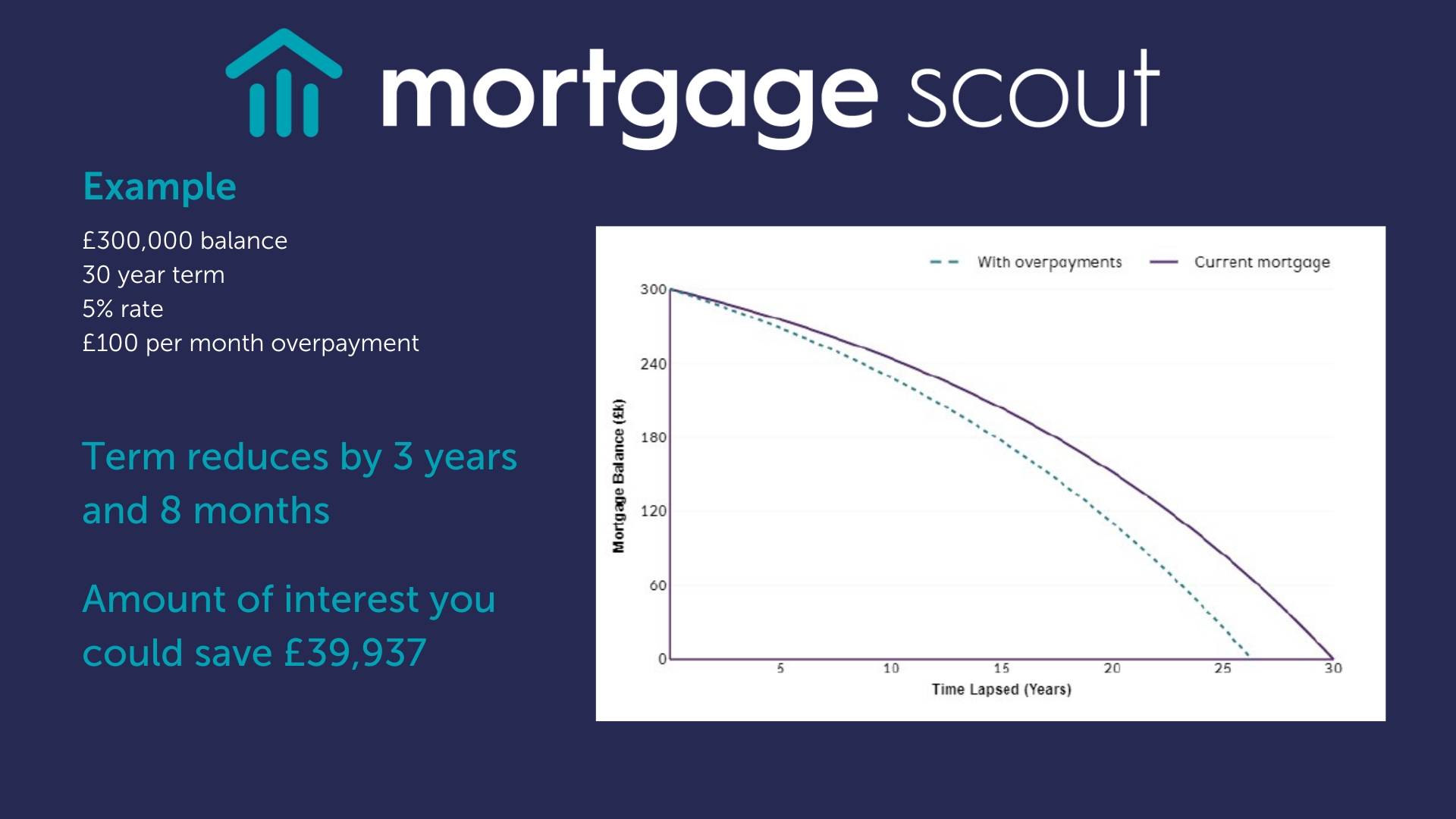

Developing a payoff strategy involves setting achievable targets and finding ways to free up additional funds to put towards your mortgage. By scrutinizing your daily spending habits, you can identify areas where you can cut back without sacrificing too much. For example, redirecting discretionary spending, such as dining out, takeaways or unnecessary purchases, towards mortgage overpayments by making an alternative choice can significantly impact the long-term outcome. Choosing a haircut every eight weeks instead of every six weeks could save you, on average, £300 per year or opting out of a takeaway every two weeks could save you on average £60 per month, £720 per year. An additional overpayment on your mortgage of £100 per month, could reduce your overall term by 3 years and 8 months, saving a total of £39,937 in interest.* based on a £300,000 mortgage, over 30 years and a 5% interest rate, please see graph for more details.

One practical approach to mortgage overpayments is to leverage mobile banking apps. These apps allow you to transfer funds to your mortgage account whenever you have a surplus. Setting up your mortgage provider as a direct payee means you can quickly and easily make an additional payment if you have funds available at the end of the month. You can gradually reduce your mortgage balance without straining your finances by making overpayments in small increments, such as rounding up to the nearest £10 or £20. Automating payments through standing orders can also be effective if you prefer a more structured approach.

Although the idea of a 40-year mortgage term may seem daunting, making consistent overpayments, even in small amounts, can significantly shorten the overall duration. For example, an extra £100 per month for five years can considerably reduce the term of your mortgage. By illustrating the potential impact of overpayments, borrowers can better understand the benefits and motivate themselves to take action.

As mortgage rates rise, it is crucial to approach the situation proactively. By tightening your spending, exploring opportunities to reduce expenses, and making regular mortgage overpayments, you can reduce the overall term of your mortgage and gain financial freedom sooner. It's essential to adapt to the changing economic landscape and make strategic decisions to secure your financial well-being. Consult with mortgage professionals to understand how these strategies can align with your specific needs and circumstances.